Under the Hood: Liquidity Pools on Doma

For decades, domain investing has had a simple liquidity model. You were either "holding and waiting" or "selling and exiting."

This of course led to the binary choice of doom:

➤ If you didn’t sell, your capital stayed locked.

➤ If you sold, you gave up the upside.

We created Doma because we believe domainers deserve a third option. Earning liquidity from market activity, without giving up ownership outright.

One of the biggest inspirations behind Doma is DeFi (or decentralized finance). Our vision was to tokenize domains and plug them into the global DeFi ecosystem to extract more liquidity and value for your domains.

Understanding DeFi and Liquidity Pools

Before getting into the Doma’s mechanics, it is important that we understand DeFi and its mechanics.

Let’s start with something every domainer already understands.

Liquidity has always been the hard part of this business. You can own a fantastic domain for years, know it’s valuable, and still be waiting for the right buyer to show up. Until that happens, the asset just sits there, quietly judging you from your portfolio.

In traditional markets, liquidity doesn’t magically appear. On stock exchanges or crypto exchanges, it’s provided by professional market makers. These are large firms whose full-time job is to stand in the middle, buy from sellers, sell to buyers, and skim a small amount off every trade. They’re fast, well-funded, and invisible. Regular users don’t provide liquidity. They simply pay for it.

DeFi flips the role of the liquidity provider. The entire point of DeFi is to remove middlemen and intermediaries. It uses something called a liquidity pool, a shared pot of two (sometimes more) assets that people can trade against at any time. For example, a domain token on one side and USDC on the other.

When someone wants to buy or sell, they don’t need another person on the other side of the trade. They trade with the pool itself. The price adjusts automatically, and the trade goes through immediately.

Liquidity pools are full of assets supplied by the users themselves. These people who put assets into that pool are called "liquidity providers” and earn trading fees for their services.

Check out Liquidity Pools on Doma

Uniswap V3 and Concentrated Liquidity

This model became even more powerful with the introduction of Uniswap V3, which added the concept of concentrated liquidity.

Rather than spreading your assets evenly across all possible prices, you can choose the price range where your liquidity is active. In practical terms, this means you’re not just saying “I’m willing to provide liquidity,” but “I’m willing to provide liquidity at this exact price range.”

Now, we have two situations.

#1 What happens when you’re in range

If the market price stays inside your chosen range, your liquidity is actively used for trades. People buying and selling pass through your position, and you earn fees as that activity happens. This is the “ideal” state. Your capital is working and generating income.

Example:

You believe a domain token will trade roughly between $90k and $110k. You set your range there. As long as the market moves around inside that band, you earn fees from every trade without selling the domain outright.

#2 What happens when you go out of range

If the price moves outside your range three things happen:

First, your position doesn’t disappear or get force-closed. It simply stops being used for trades.

Second, your fee generation pauses until the price comes back into range.

Finally, when the position goes fully out of range, it will usually sit entirely in one side. As mentioned above, your liquidity is split in two assets (for example, ETH and USDC). When the price moves out of range: Your position automatically converts fully into just one asset You no longer hold a balanced pair This is what people mean by a “single-sided position.”

Example:

In our ETH/USD case:

- If the price moves above your range, you may end up holding mostly USDC.

- If the price moves below your range, you may end up holding mostly the domain token.

Nothing breaks. You’re just no longer active at current prices.

By utilizing these mechanics, Uniswap V3 utilizes capital more efficiently, and pricing starts to resemble how real markets actually work.

Compared to centralized exchanges, this is a very different setup. There’s no approval process, no special status, and no institution deciding who gets access. The market runs continuously, and the rules are the same for everyone. It’s less “Wall Street trading floor” and more “automatic vending machine that never sleeps.”

Managing Your Liquidity Position to Optimize Earnings

Providing liquidity isn’t a “set it and forget it forever” decision, but it also doesn’t require staring at charts all day. When it comes to the Uniswap V3 concentrated liquidity model, we have learned two things:

- When your liquidity is in range it earns fees.

- When it is out of range, it doesn't.

So managing a position in this model mostly comes down to deciding how active you want to be.

If you believe a domain token will trade sideways within a fairly stable band, a tighter range makes sense. Your liquidity is more concentrated, which generally means higher fee generation while price stays there.

If you expect larger price swings, or you simply don’t want to monitor things closely, a wider range or even full range is more appropriate. You’ll earn lower fees per trade, but your position stays active more often and requires less attention. This is essentially passive holding and yield generation.

The key point is that nothing is forced. You can always:

- Adjust your range

- Add or remove liquidity

- Take profits

- Or simply wait for price to move back into range

So, how does this matter for domainers?

For domainers, the relevance is simple. Liquidity pools don’t force a sale or require a buyer to fall in love with your asset. They allow market activity to generate income along the way.

That’s the real breakthrough here. DeFi protocols turn asset ownership from a waiting game into something a little more productive.

Doma uses Uniswap V3 as the trading and liquidity engine for its tokens.

How Liquidity Pools Work On Doma

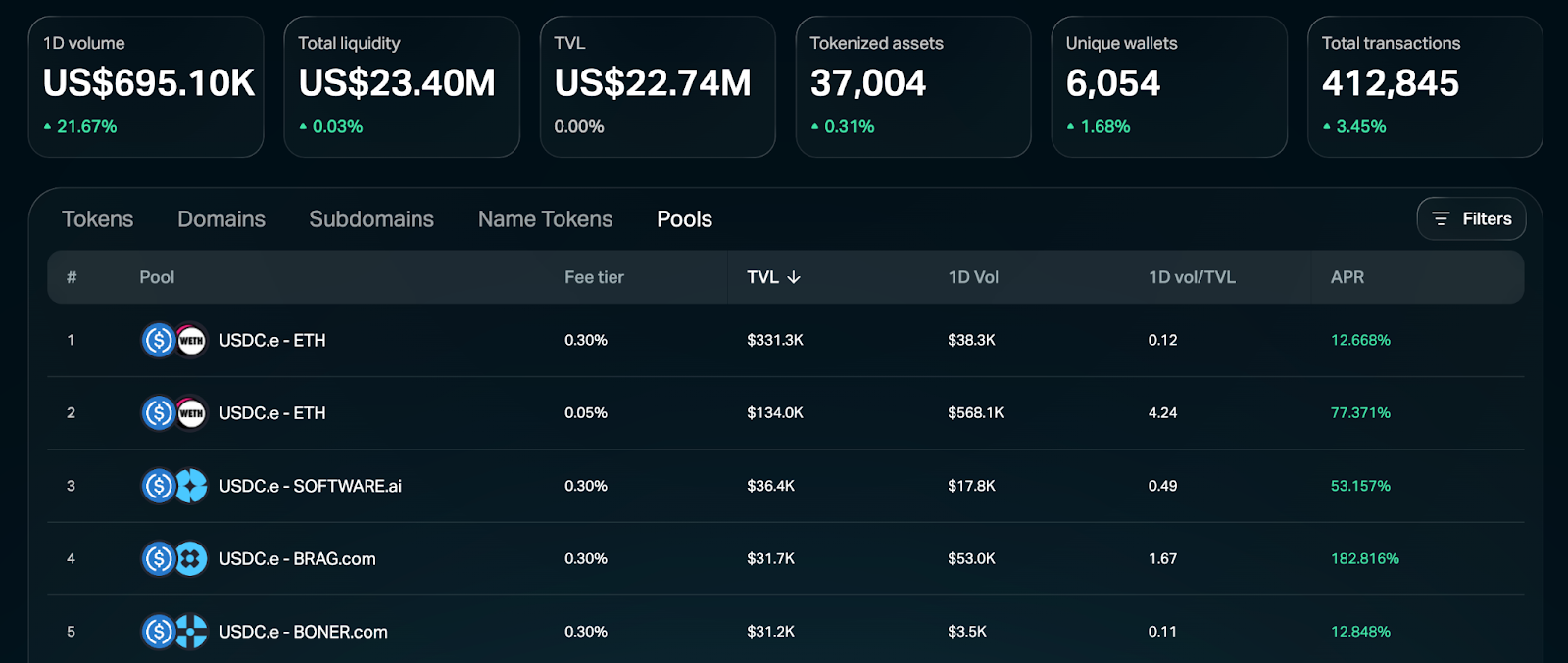

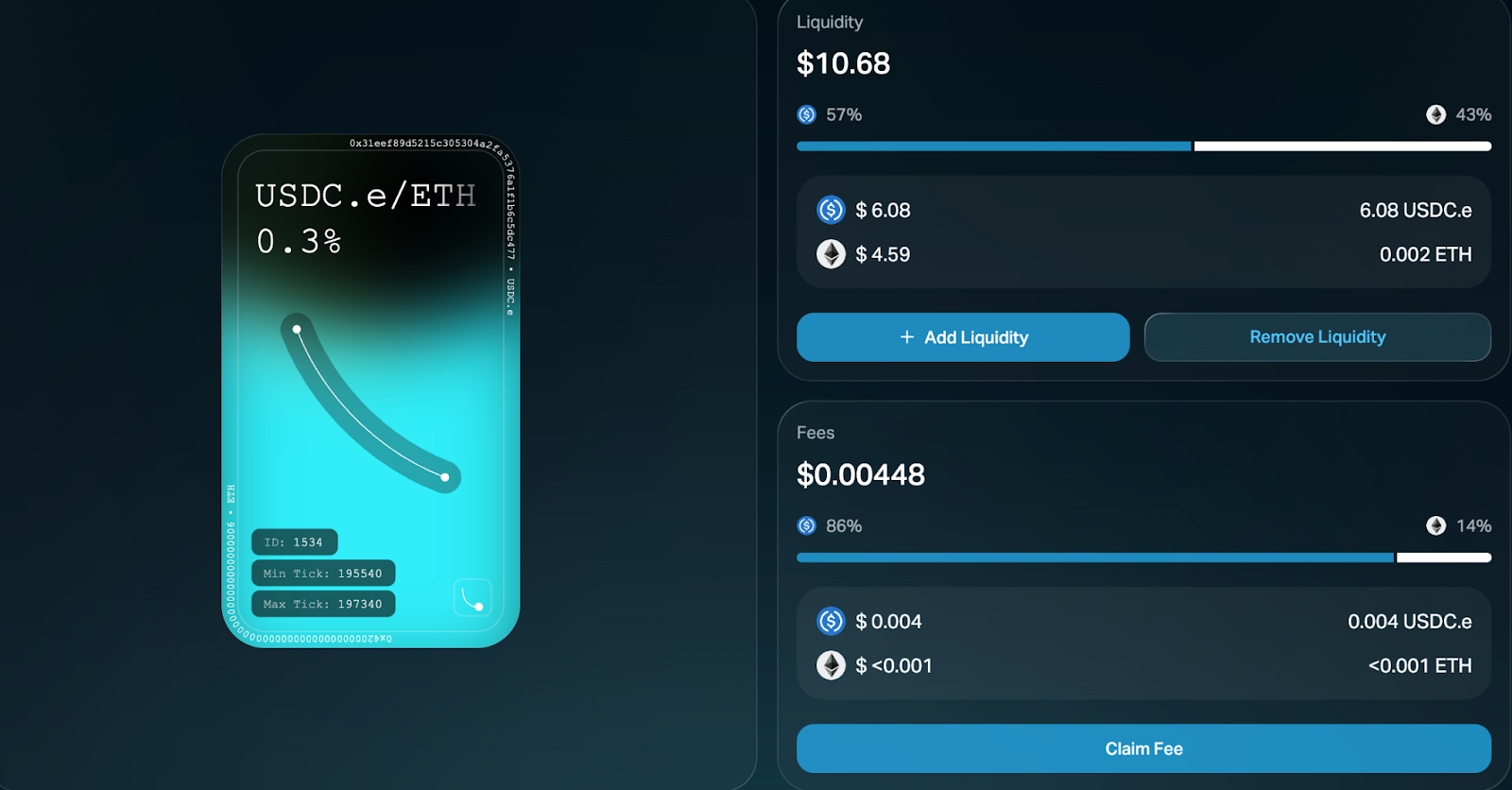

Ok, so you have decided to become a liquidity provider for Doma. Let’s guide you through the interface. These are all the pools currently available in Doma.

Here you will see the most popular pools in Doma as ranked by TVL. TVL or “total value locked” is the total value of the tokens that’s currently locked inside the pool. Another

In liquidity pools, APR (Annual Percentage Rate) shows your estimated yearly return from trading fees from each pool. Higher the APR, higher your returns.

You can also see that there are two “USDC-ETH” pools in the list. The difference is the Fee tier used. The pools on Doma have four fee tiers: 0.01%, 0.05%, 0.30%, and 1%. Majority of the pools are going to be 0.30% or 1%.

Check out Liquidity Pools on Doma

Adding Liquidity in Doma

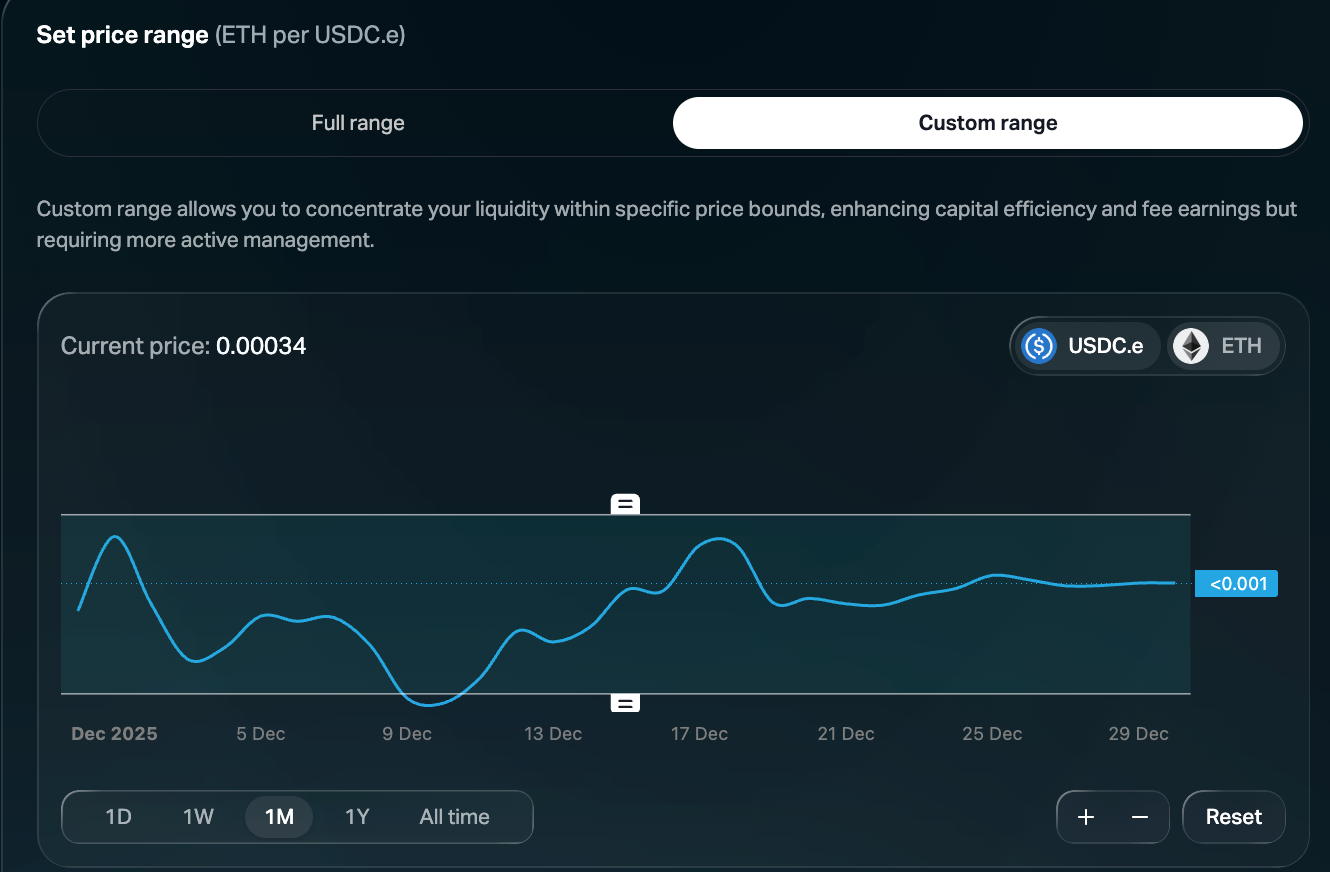

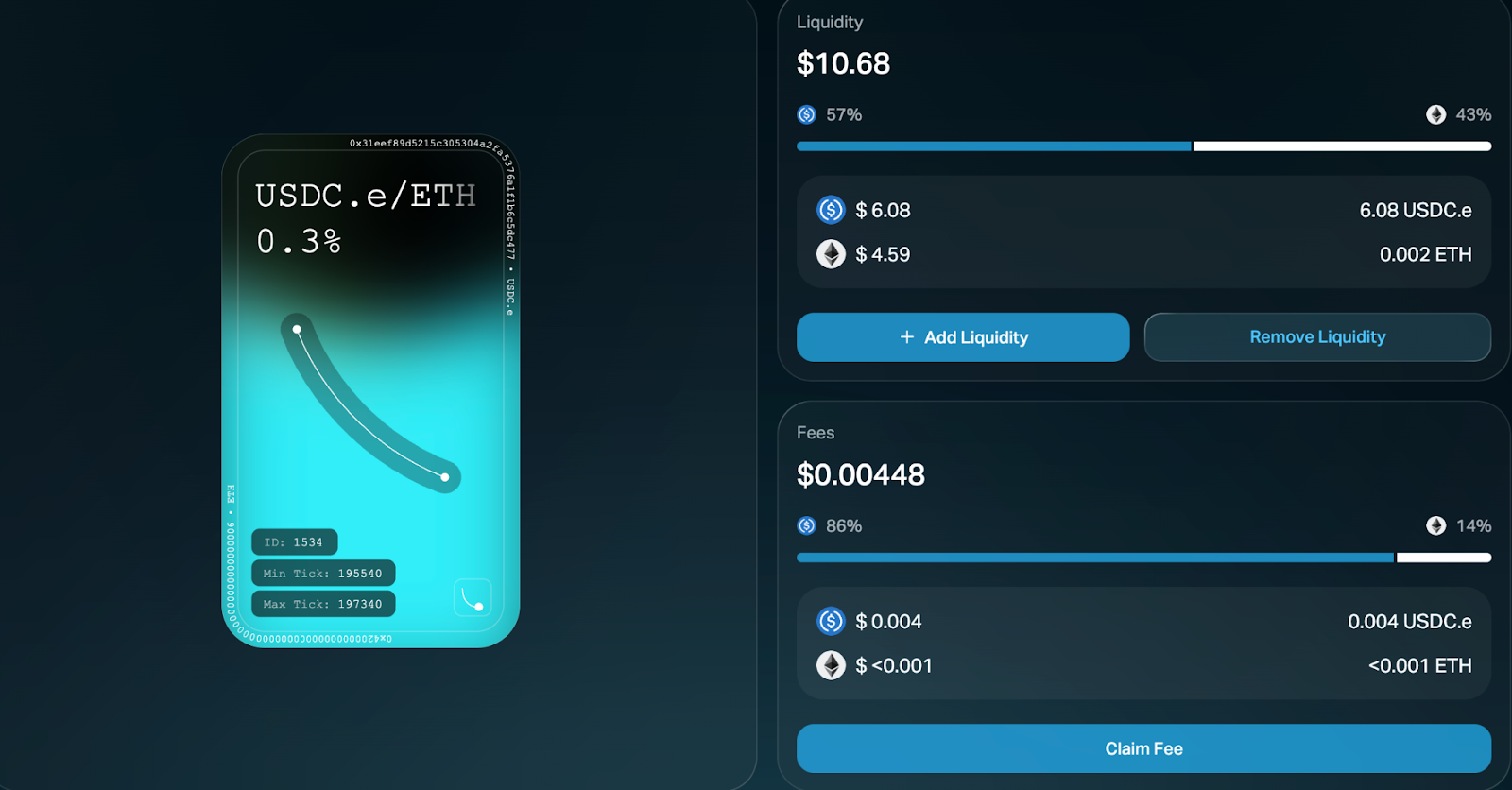

So, we are going to add liquidity in the USDC.e/ETH pool with the 0.3% fee tier. When you click on the pair you will be redirected here.

Now, this is where you will see the Uniswap V3 mechanics come into play. You can spread your liquidity across the full range or you can choose a custom range. Customize the range as you see fit. Your tokens will be used for trade only when the price is in the range you specify.

However, if you don’t want to bother with that, feel free to choose the “Full Range” option. Do keep in mind that choosing a range allows our system to use your liquidity more efficiently.

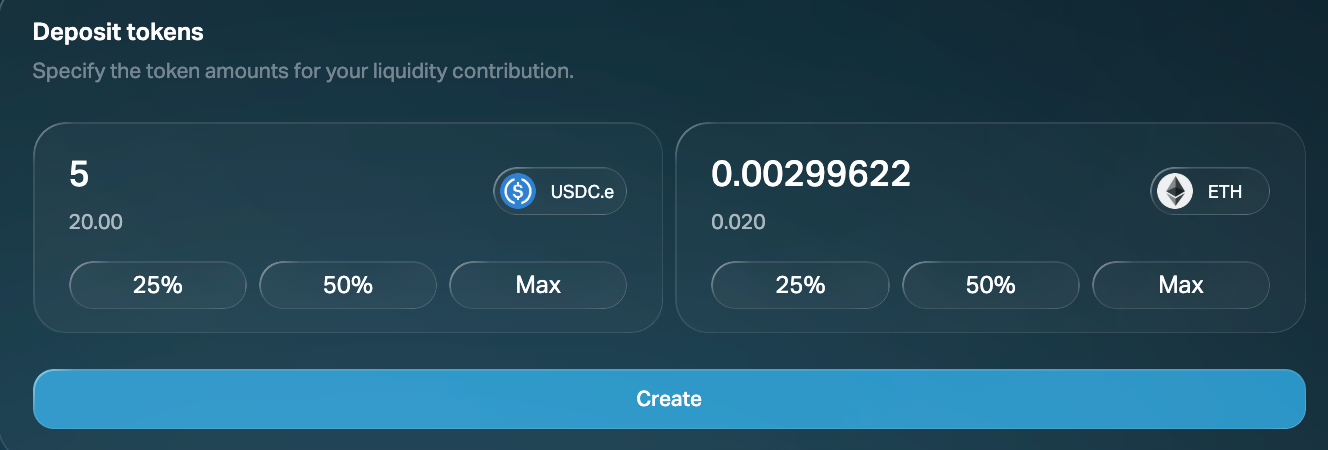

Up next, let’s deposit our tokens. Before you do so, make sure you have bridged the tokens to Doma if needed. In this case, we needed to bridge both USDC and ETH to Doma. You can bridge via Stargate.

In this example, we are choosing to lock in 5 USDC and an equivalent amount of ETH (the ETH amount will be updated automatically) into the pool

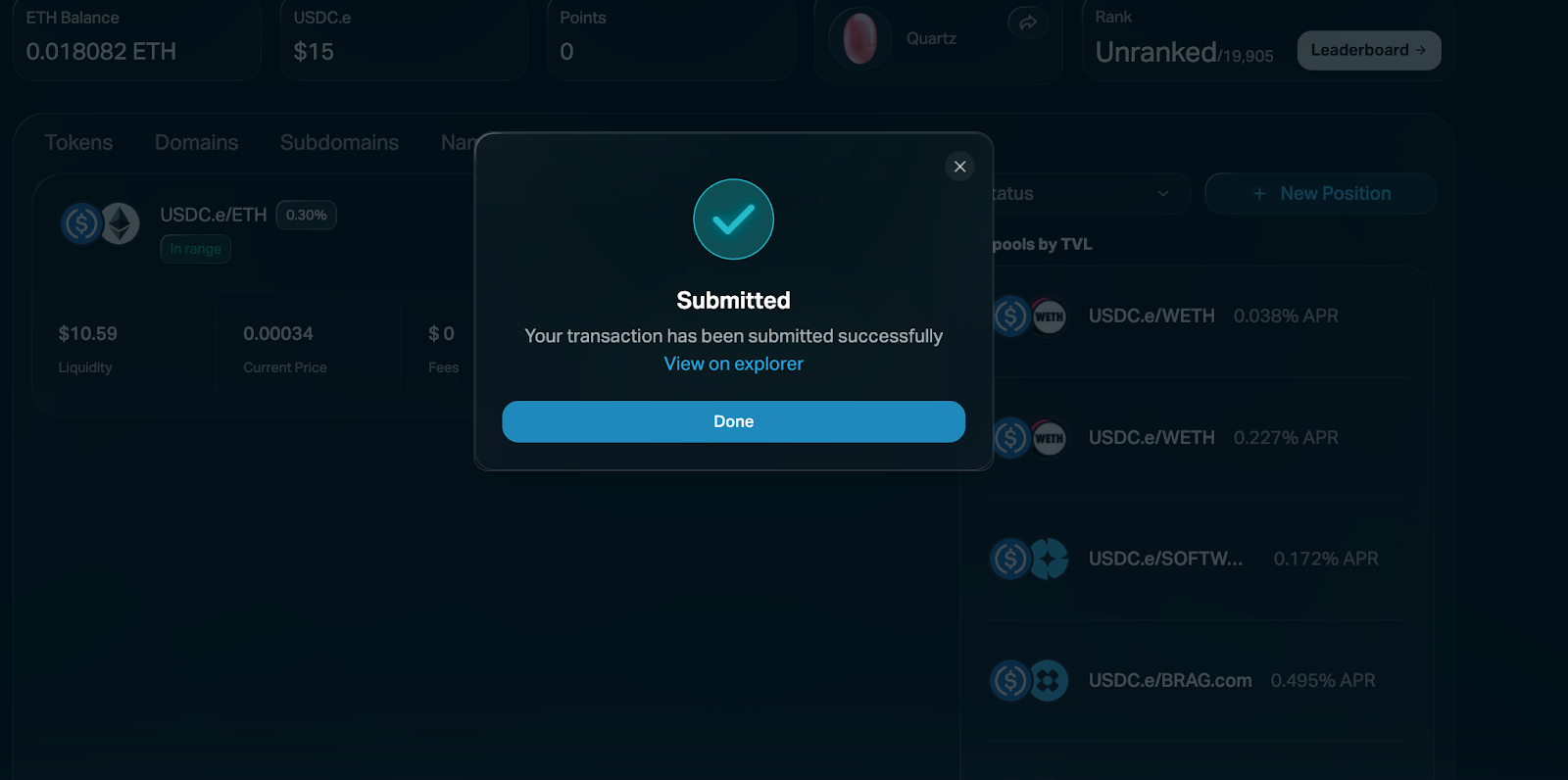

You will get a confirmation message and prompts to sign certain requests in your wallet. Once confirmed, the transaction will be submitted to the blockchain.

And that’s pretty much it. You can check your position any time you want. You may add more liquidity or claim your rewards from fees. Do note that every time you earn LP fees you earn points in the Doma Leaderboard. For more information about the Leaderboard read our blog.

And that’s pretty much it! You can check your position any time you want. You may add more liquidity or claim your rewards from fees. Make sure to rake up those points and rewards!

In Closing

Adding liquidity and earning fees is one of the cornerstone mechanics of DeFi. It allows you to earn passive income easily on your assets.

This is just the beginning. As more domainers tokenize their assets and participate in pools the ecosystem grows deeper. Higher TVL means tighter spreads, better price discovery, and higher APRs for providers. This doesn’t replace traditional domain sales, and it isn’t meant to. It simply adds a third path - turning domains from passive holdings into productive assets.

For an industry that has spent decades waiting for liquidity to arrive, the waiting game is over.

Check out the Doma App