Introducing Mizu Launchpad for Domains

By Michael Ho, CBO & Co-Founder, D3

Today, we are excited to launch Mizu - the world's first DeFi launchpad built for trading domain-backed tokens. Inspired by the Japanese word for “water,” Mizu represents flow, movement, and liquidity, exactly what the domain market has been missing.

Available on Doma Protocol testnet, the industry standard, DNS-compliant blockchain for tokenizing and bridging internet domains to Web3 ecosystems, Mizu takes a leap forward by bringing Doma domains to DeFi. For the first time, domains can flow like modern financial instruments: liquid, tradable, and dynamic.

We’ve built Mizu on the lessons, successes, and even the chaos of DeFi’s most iconic launchpads and exchanges. Platforms like Hyperliquid, Jupiter, and Meteora showed how liquidity, routing, and vault mechanics can unlock real depth and resilience for traders. We wondered "what if we put fungible token pairs backed by domain assets on a launchpad?"

The result is a marketplace and launchpad that treats domains on Doma as DeFi-ready assets.

Before we get into the launchpad mechanics, let’s take a step back and understand what tokenized domains on Doma entail.

Doma: From DNS-Compliant NFTs to ERC-20 Fungibles

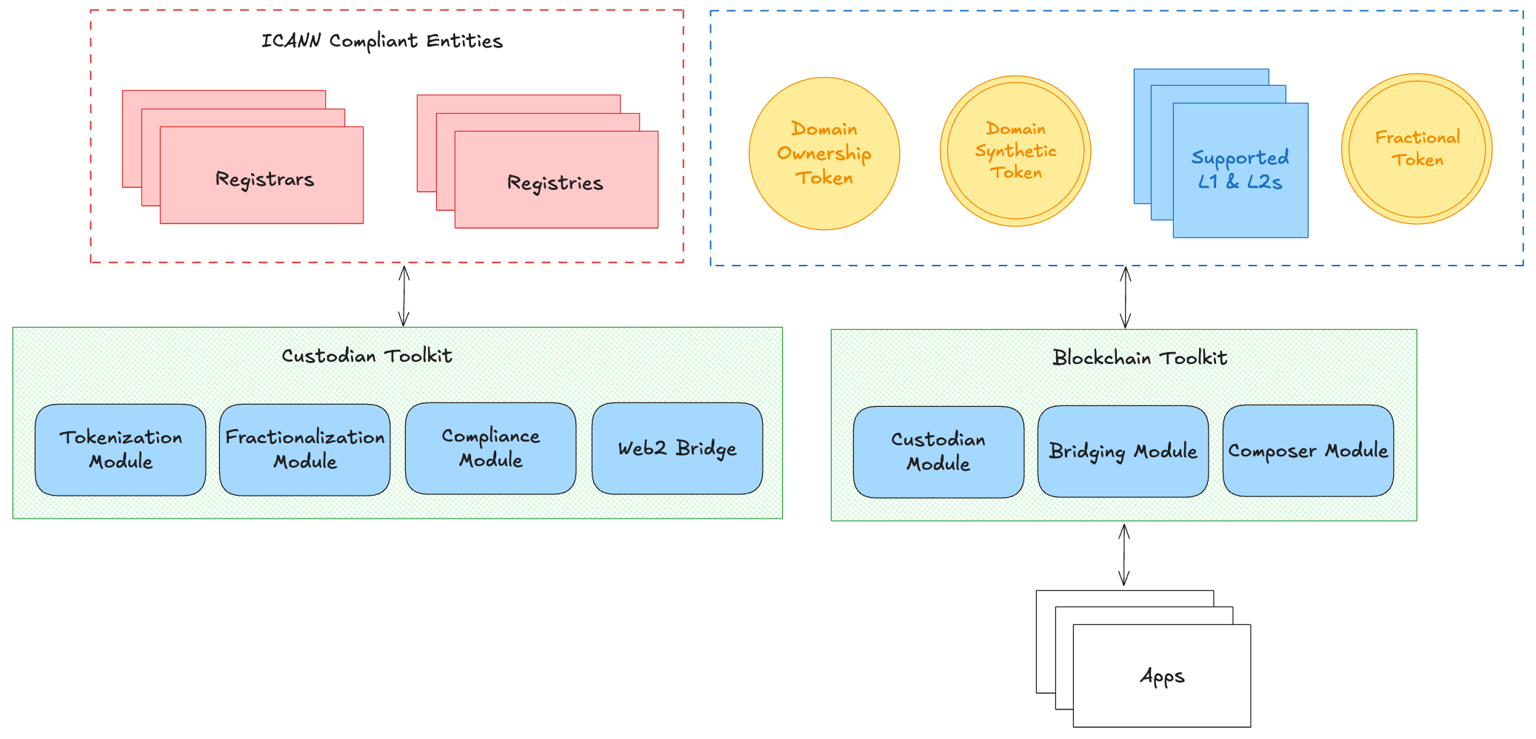

At its core, Doma tokenization begins by minting a domain as an NFT and locking it into a DNS-compliant smart contract. This serves two key purposes:

- The tokenized domain remains recognized within the universe of DNS-based registrar systems to maintain custody while simultaneously gaining the ability to interact with Web3 ecosystems. These domains can come on-chain from a variety of sources including Doma-compatible registrars like NicNames.

- Once the domain NFT is secured, Doma can tokenize it further into fungible ERC-20 tokens.

Mizu builds on the core architecture of Doma. It provides the launchpad for ERC-20 domain tokens to be listed, traded, and connected to on-chain liquidity.

Beyond Fractional Ownership: Unlocking Full DeFi for Domains

Fractionalization is table stakes for unlocking liquidity for domains. It can decompose monolithic assets into smaller pieces, but it’s only the starting point for domain owners. Shared ownership is just one potential use case of domains.

With Mizu, domain owners aren’t limited to static ownership splits. They gain the flexibility to decide how liquidity flows, whether through staking, pools, or new market structures that treat domains as dynamic, financial-grade assets - all while respecting and maintaining DNS and ICANN compliance.

Doma and Mizu were designed to give domain investors access to the full spectrum of DeFi primitives. If you own premium domains and are looking to tap into Web3 to generate more liquidity from them, we’d love to work with to you through a new program called Doma Prime.

Through Doma Prime, domain owners can decide exactly how to financialize their premium assets, including:

- Listing only a percentage of their domain into circulation, while retaining majority control

- Renting or leasing rights to specific domain utilities, like a subdomain or email service

- Trading their tokens across other DEXs

- Bridging to other chains like Solana, Base, or Avalanche

- Earning yield from staking

- Enabling buyouts and redemptions on-chain

- Generate fees from on-chain transactions

Fractional ownership isn’t the endgame. Programmable liquidity is. That’s the core philosophy behind Mizu.

How Mizu Works: A Closer Look at the Launchpad

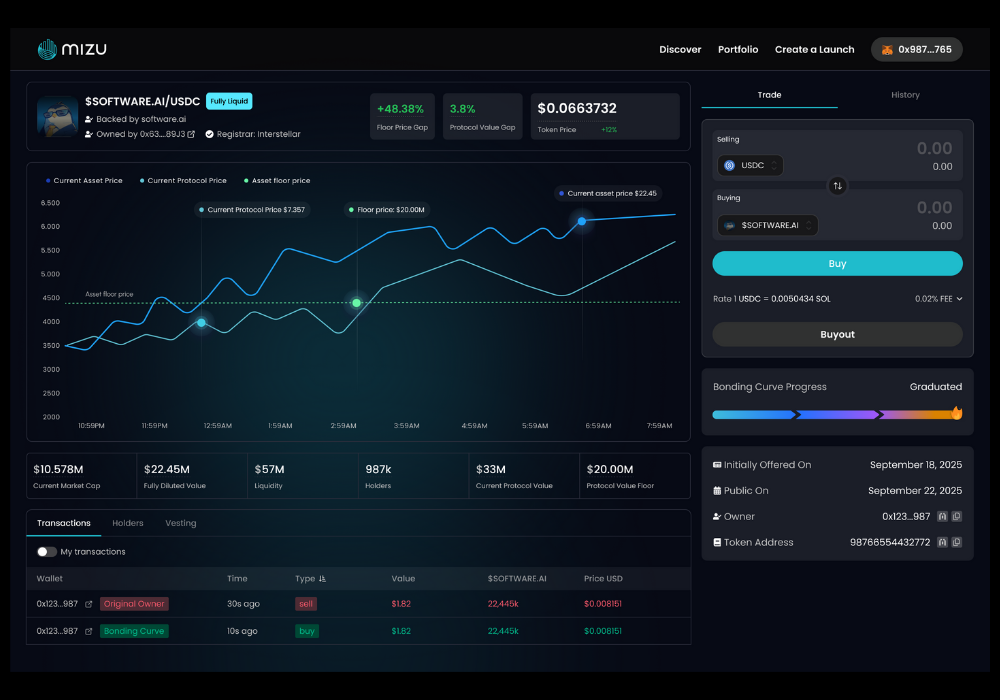

DeFi traders will find the overall interface and experience of interacting with Mizu quite familiar. Mizu lists domain tokens as tradable pairs, enabling minting, trading, buyouts, and redemptions through a single interface.

#1 DeFi Interactions

Once minted, domain tokens can be bridged to popular chains like Base or Solana. Mizu aggregates these bridged tokens into active pairs on its marketplace.

Traders interact with them just as they would with any DEX listing by swapping, trading, and providing liquidity in a few easy steps:

- Connect a supported wallet to Mizu

- Choose from the listed domain token pairs

- Buy or sell tokens against USDC or other supported assets

- Provide liquidity to a pool to earn a share of trading fees

#2 Buyout Logic and Market Floors

The buyout mechanism is where Doma’s design becomes directly relevant to trading strategy. Smart contracts enforce that any user can acquire the underlying domain NFT by paying the greater of two values:

- Floor Price: Set by the domain owner at the moment of fractionalization.

- Fully Diluted Market Cap: Calculated dynamically from live DEX pricing (token price × total supply).

When a buyout occurs, the NFT is transferred to the new owner. Unlike memecoins or pump tokens, domain-backed tokens cannot be bought out below the Floor Price, thus guaranteeing a minimum buy-back price set by the owner.

#3 Redemption and Settlement

Once a buyout occurs, fractional tokens stop representing ownership but don’t become worthless. Doma’s contracts allow holders to redeem their tokens for USDC proportional to their share of the buyout price. Tokens may still trade on the open market until redemption is completed, but the guaranteed payout remains accessible.

#4 Price Discovery and Market Data

Behind the scenes, Doma continuously references live token prices from integrated DEXs to calculate FDMC and maintain accurate buyout thresholds. Mizu is where that data is surfaced in real time. Charts, order books, and dashboards all pull from these feeds, ensuring that what speculators see reflects on-chain reality, not opaque valuations.

Mizu: Where Domains Go DeFi

A Mizu domain token is much more than just owning a share in the domain. It’s the way to make a domain DeFi ready. The tokens are freely tradeable through standard DEX interfaces across Web3, while oracles open the door to a whole new aperture of existing DeFi apps.

This allows the domain’s utility to be traded along with the tokens. The tokens themselves can represent the use of domains and be regulated through DAOs. Alternatively, domain tokens can represent on-chain DNS access or identity through app-level primitives like sub-domains and email using Doma. Mizu and Doma don’t dictate how domains are used, but rather open the door to innovation by providing protocol-level guarantees of domain custody and access through fully on-chain mechanisms. We’re so excited about the innovation potential that we launched a $1M USDC grant program for builders to developer DApps on Doma.

Mizu vs Others: What Traders Should Know

As we mentioned above, Mizu has been built on the shoulders of giants. While there are a lot of similarities in the way the UX works, there are some key differences.

Many DeFi trading platforms give you pure speculation. Often, the tokens that you are trading on these platforms don’t have any real-world utility or tangible value. The value comes from tokenomics and supply/demand manipulation. You buy, sell, and hope there’s liquidity when you want to exit. If the hype dies, you’re often stuck holding worthless tokens.

Domains, on the other hand, are not just speculative symbols. They’ve always been real-world assets, digital real estate with fundamentals that most meme tokens lack:

- Brand equity as the building blocks of digital identity and online storefronts

- Tap into use real DNS use cases like leasing that generate cash flow

- Resale value from active secondary markets

- Immediate access to DeFi primitives like lending and DAO governance

Every single token pair on Mizu is tied to a real, DNS-compliant domain. So, while the tokens might trade with the energy and spirit of DeFi, they are also anchored in the scarcity and utility of the underlying domains. Plus, Doma’s contract-enforced buyout mechanism guarantees that token holders can redeem value even if the market dries up.

Own and Trade the Internet

Tokenized domains may be the most ideal form of digital assets. They carry the cultural weight and viral energy of memecoins, but unlike pure speculation, they are backed by real value and utility. Now with Mizu, these assets gain the full financial utility of advanced DeFi infrastructure, making domains liquid, as the name suggests. Beyond liquidity, Mizu unlocks entirely new incentives for domains as assets, opening them up to Web3 marketplaces, composable ecosystems, and financial utilities that go far beyond traditional use cases. Mizu’s launch firmly establishes domains as a new financial primitive - the foundation for how we’ll own and trade the internet in the years ahead.

Join our growing Discord community to stay up to date with the latest news from Doma.